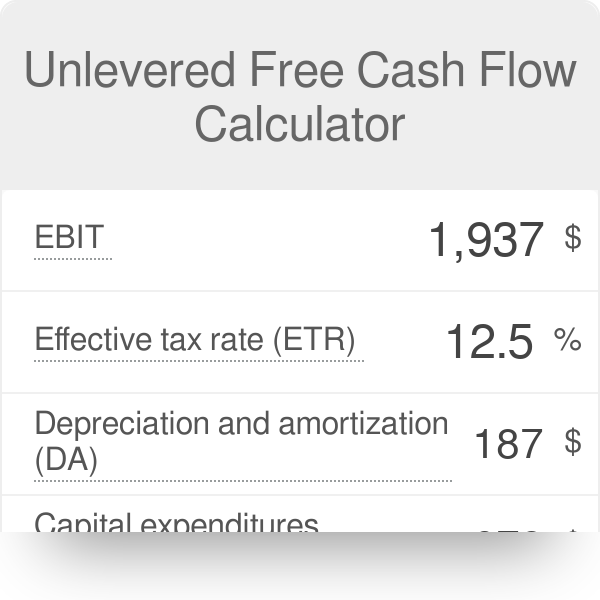

unlevered free cash flow calculator

Levered free cash flow on the other hand works in favor of the. Unlevered Free Cash Flow.

Unlevered Free Cash Flow Definition Examples Formula

Our Business Consultants Will Partner With You To Build Financial and Operational Success.

. To calculate unlevered free cash flow we must take the companys EBITDA 200000 deduct the capital expenditures 300000 and deduct working capital 50000. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things.

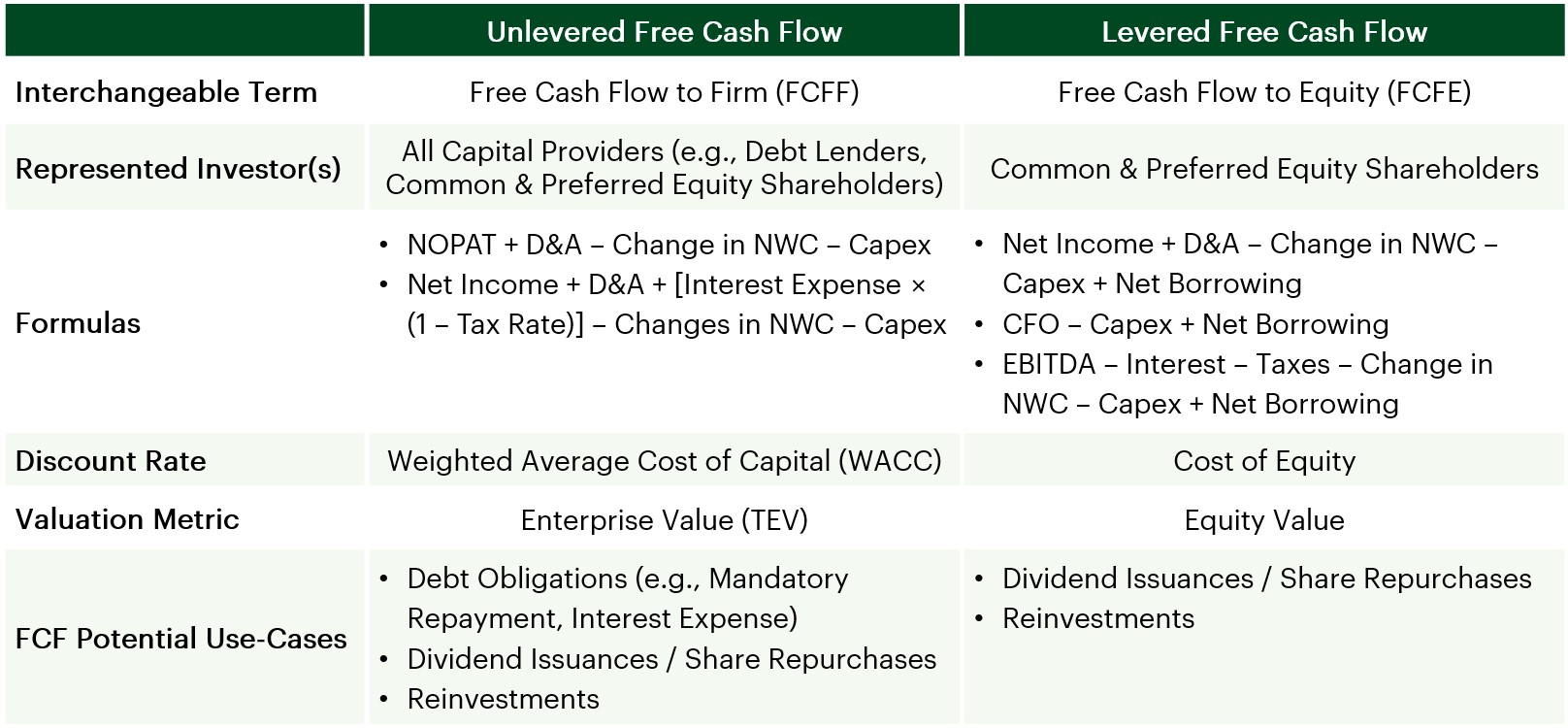

Ad The worlds largest software App discovery destination. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the.

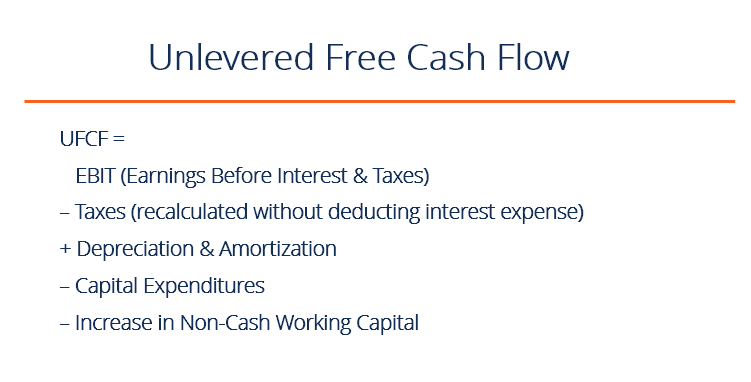

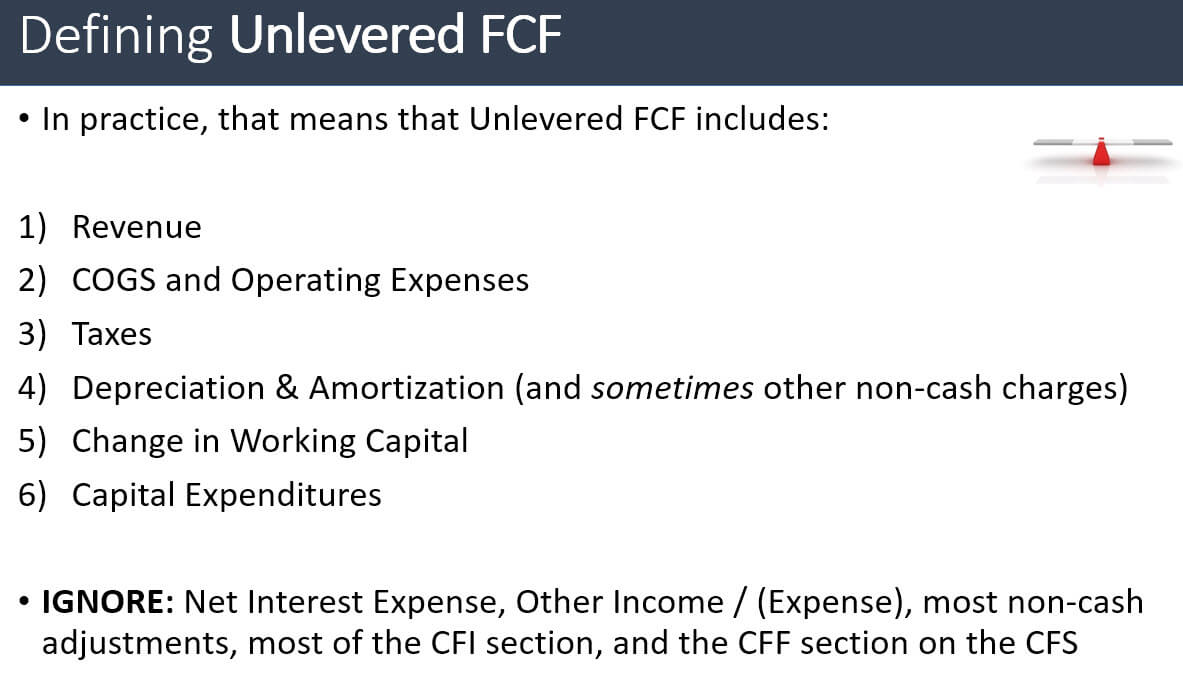

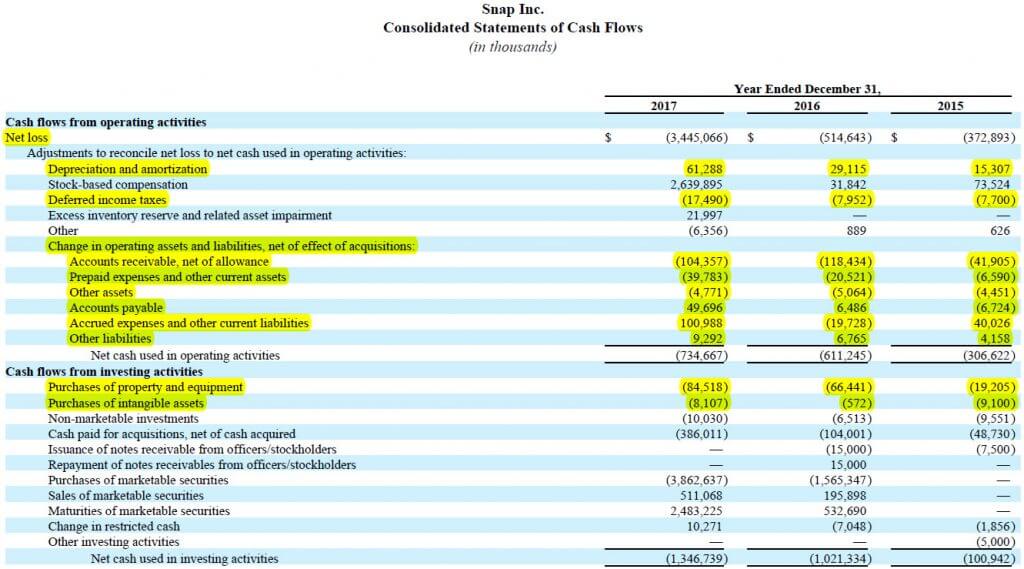

Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered Free Cash Flow Free Cash Flow Calculation EBIAT Depreciation from FBE 421 at University of Southern California.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Unlevered Free Cash Flow. The difference between UFCF and LFCF is the financial obligations.

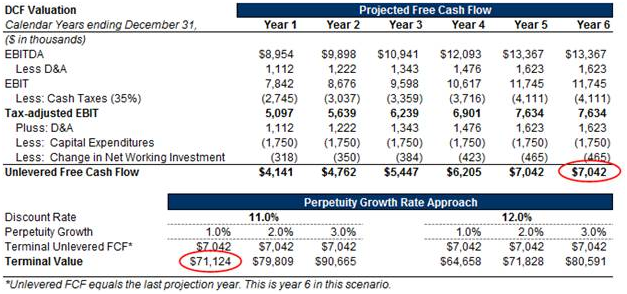

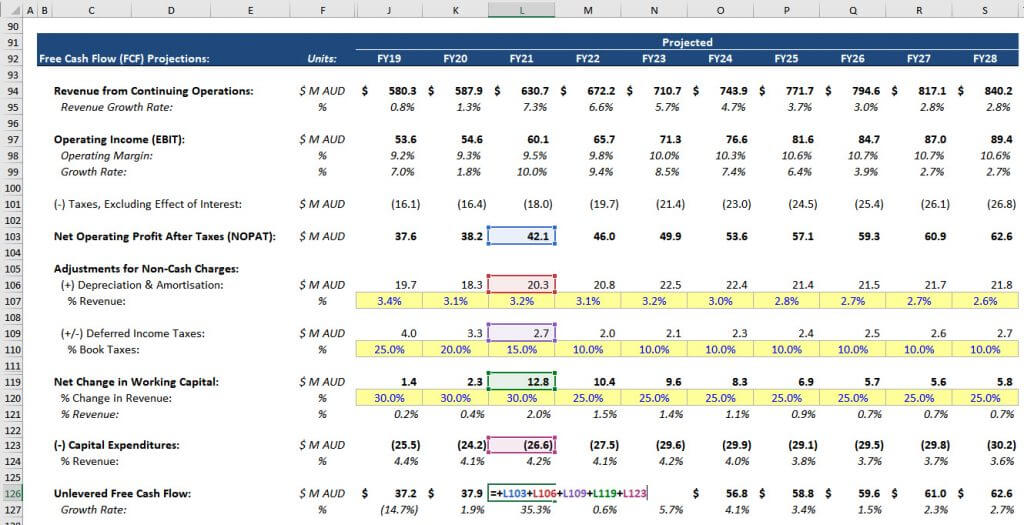

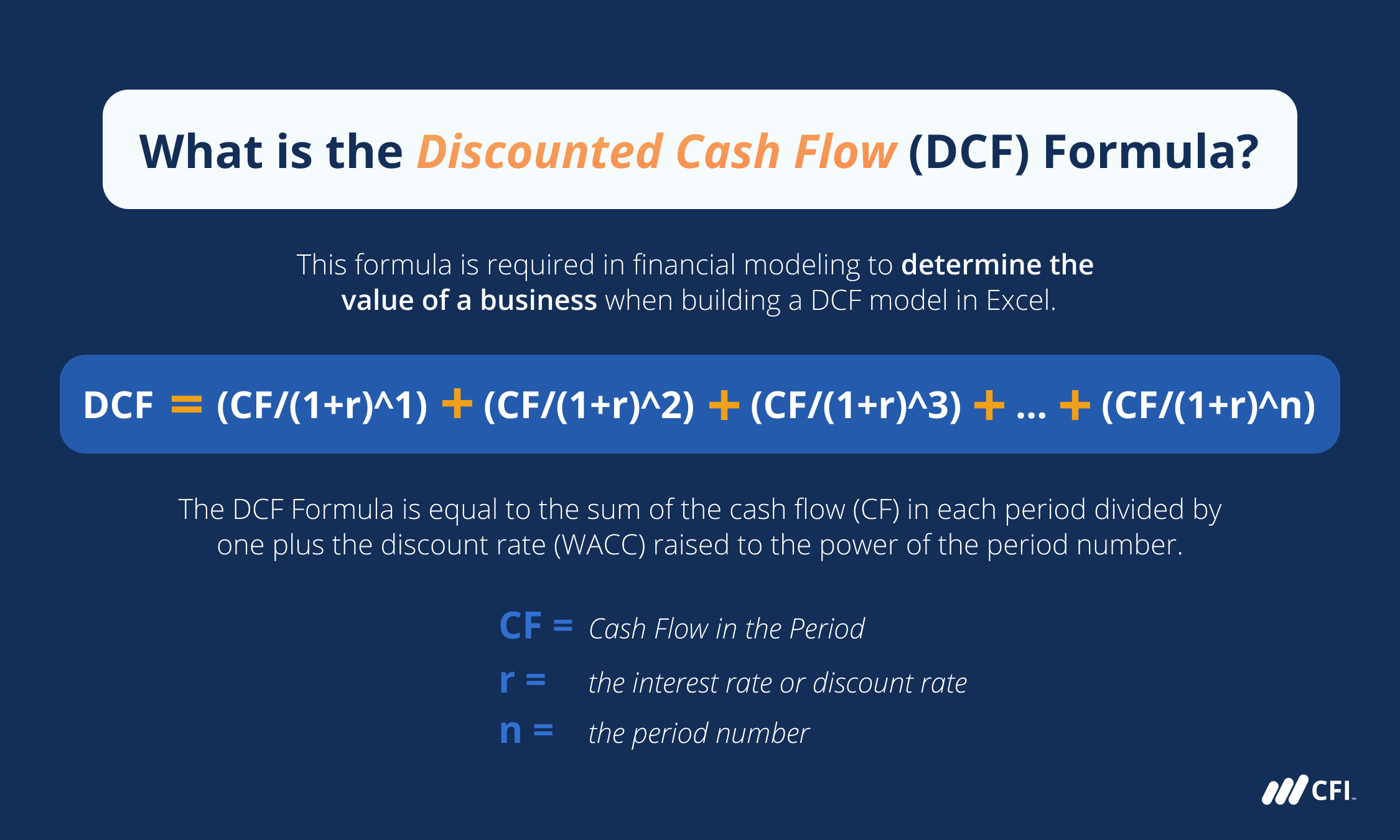

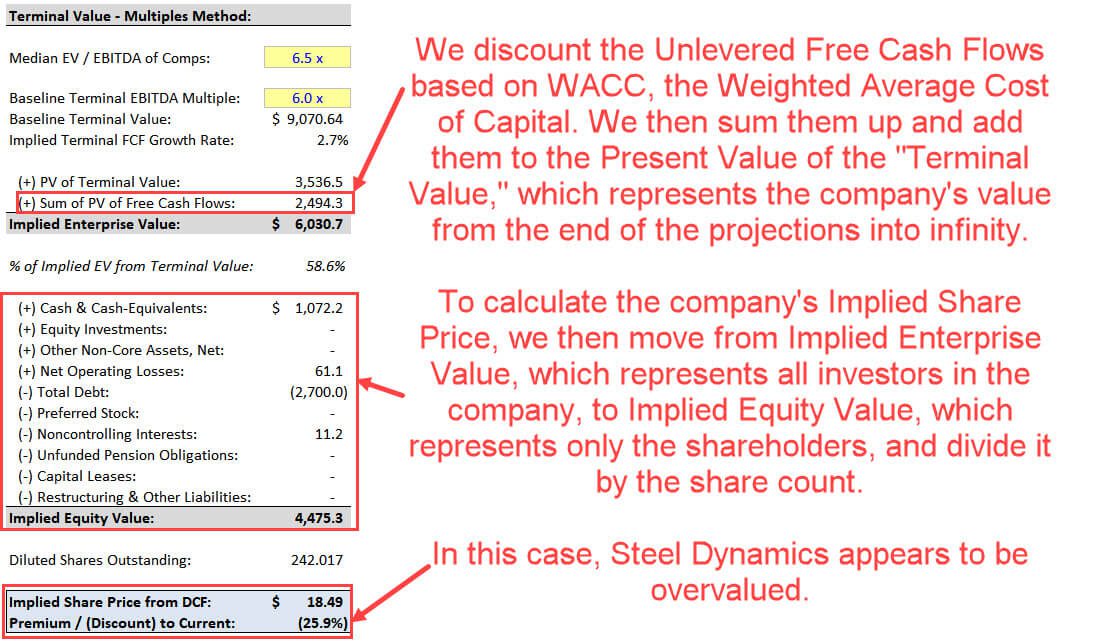

This metric is most useful when used as part of the discounted cash flow. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. You can see the entire formula in Excel below.

Get 3 cash flow strategies to stop leaking overpaying and wasting your money. Essentially this number represents a companys financial status if they were to have no debts. Unlevered Free Cash Flow - UFCF.

A business or asset that. Unlevered free cash flow is the gross free cash flow generated by a company. Unlevered FCF growth should slow.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Start with Operating Income EBIT on the.

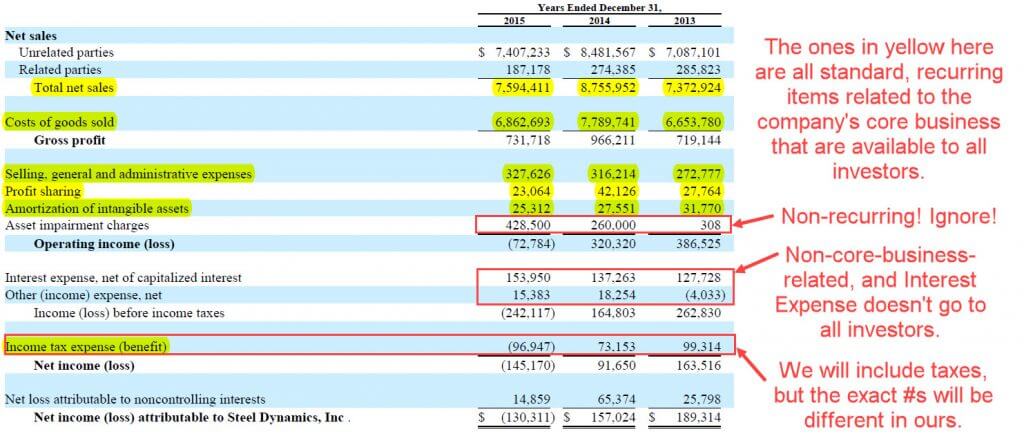

Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an. Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account. Unlevered free cash flow is a term used in corporate finance and investment analysis to discern a companys value.

Unlevered Free Cash Flow Formula. Understanding the difference between levered and unlevered free cash flow can help you make sense of the tools a company relies on to raise funds MC Problem. So these are the.

Rated the 1 Accounting Solution. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. In other words its a measure of how.

It is the amount of cash a company generates after. Unlevered free cash flow. Unlevered free cash flow is the cash flow a business has excluding interest payments.

The Best downloads for any device. Ad QuickBooks Financial Software. Leverage is another name for debt and if cash flows are levered that means they are net of.

The generic Free Cash Flow FCF Formula is equal to Cash from Operations minus Capital Expenditures. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and. Unlevered free cash flow is calculated in the same way that you would calculate any type of cash flow statement - the difference between operating profit and capital expenditures.

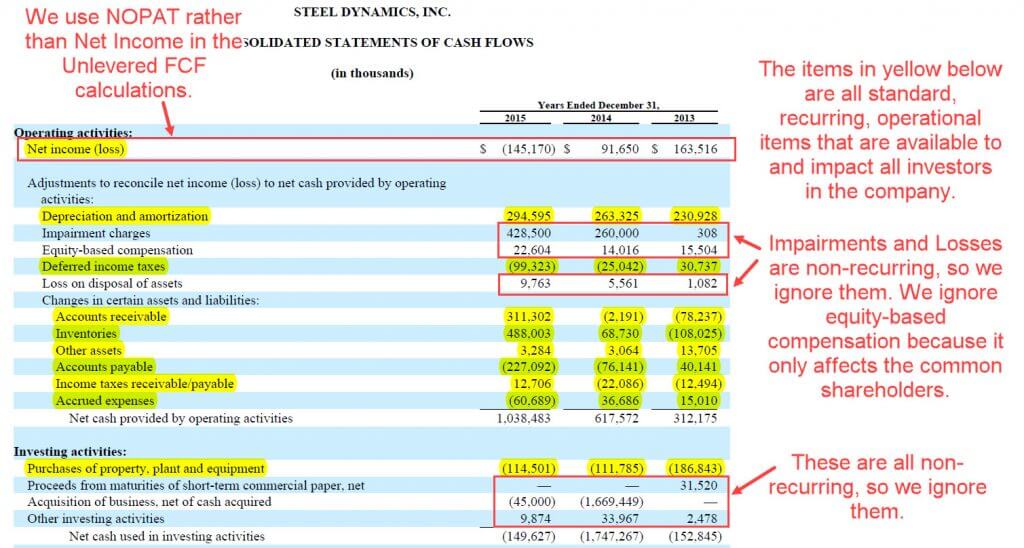

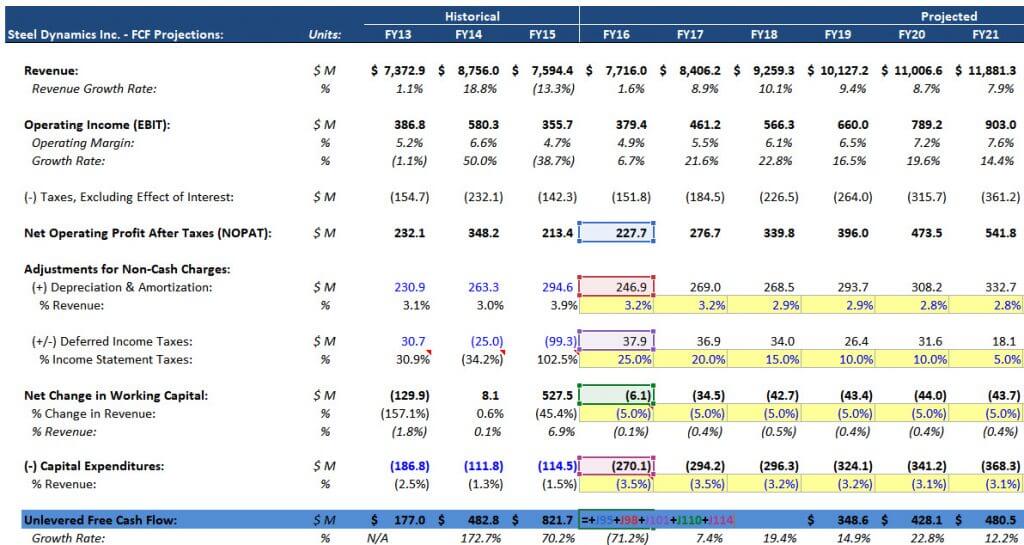

FCF represents the amount of cash generated by a business. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

Ad The Key To Success Is Gaining More Control Over Cash Flows. Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable. Levered Free Cash Flow.

Its principal application is in valuation. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. HSBC Can Help You With That. Speak To An HSBC Representative To Learn More About Our Commercial Banking Services.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

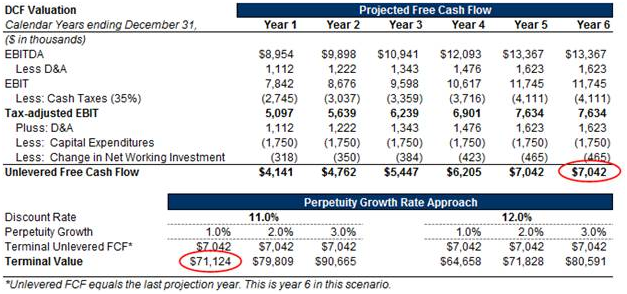

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Calculator Ufcf

How To Calculate Free Cash Flow Excel Examples

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial